Dive Brief:

- The construction unemployment rate rose to 3.9% in August, a significant jump from July’s nnear-recordlow of 3.5%. This provides evidence that the sector’s overheated jobs market is beginning to cool without cratering.

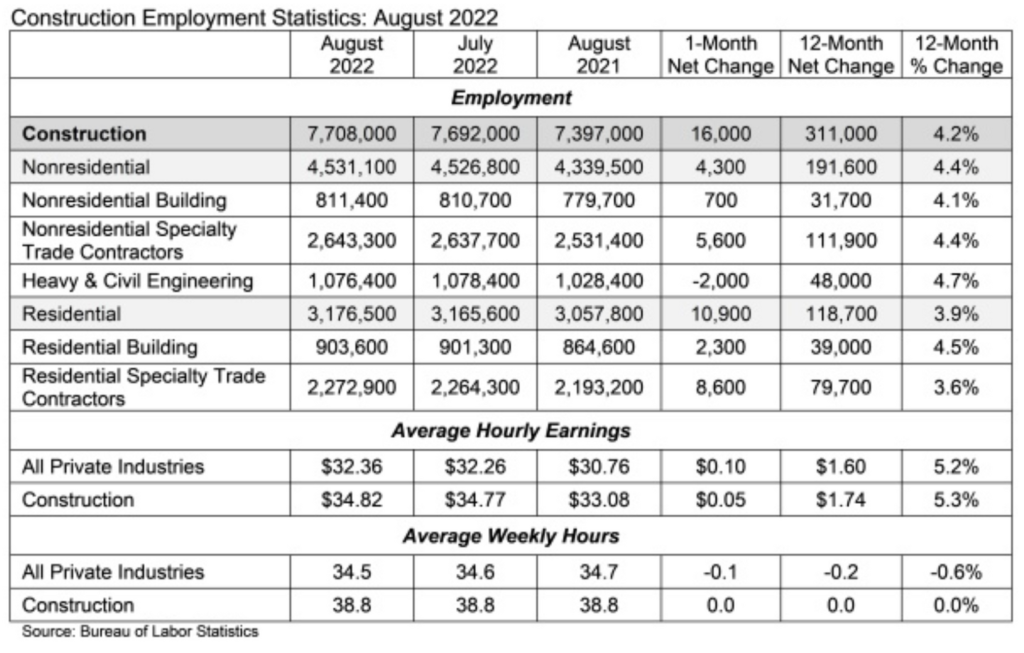

- According to an analysis of Bureau of Labor Statistics data by Associated Builders and Contractors, nonresidential construction employment rose by a net of 4,300 positions. Nonresidential specialty trades added 5,600 new jobs, while nonresidential buildings added 700. Heavy and civil engineering employment fell by 2,000 posts.

- After declining for several months, the labor force participation rate — a measure of people working or looking for work — rose meaningfully, according to Basu, from 62.1% to 62.4%. With wages expanding 5.2% in all industries over the last year, and 5.3% in construction, it’s an indication that a combination of inflation and rising pay rates have induced workers back to their jobs, after the departure of the Great Resignation.

Dive Insight:

In the overall economy, the unemployment rate rose to 3.7% in August, an uptick of two-tenths of a percentage point. With the Federal Reserve watching each successive economic report for clues about where the economy is headed, Wall Street cheered the news, since it provided evidence that policymakers may not need to raise interest rates more than already planned.

“This jobs report represents good news for contractors,” said Anirban Basu, ABC’s chief economist. “The rise in the overall unemployment rate from 3.5% to 3.7% and the expansion in construction worker unemployment from 3.5% to 3.9% means that the labor market has loosened a bit.”

While year-over-year construction wage gains are still historically high, they only jumped by 5 cents in August from the month before, less than a tenth of a percent, to $34.82 per hour on average. That also could signal more measured times ahead for contractors, who have been dealing with the double hit of rising wages and costs on materials.

“There was also evidence that compensation growth is slowing, which is a relief to contractors who have become increasingly pessimistic about their profit margins,” Basu said. “While this will not alter the Federal Reserve’s present posture of raising interest rates, the process of labor market normalization appears to be underway.”

But one month’s news by no means indicates construction’s labor woes are over. Earlier this week, the Associated General Contractors of America issued a warning that the sector’s worker shortage is threatening the success of federal infrastructure projects.